BHP, the world’s biggest miner, warned Tuesday that demand for resources could be hit by the novel coronavirus outbreak in China unless the epidemic is contained by the end of March.

The resources giant warned demand for its products would likely dip as a result of the novel coronavirus outbreak in China, with oil, copper and steel use all set to decline unless if the disease continues to spread.

“If the viral outbreak is not demonstrably well contained within the March quarter, we expect to revise our expectations for economic and commodity demand growth downwards,” it said in a statement.

More than 72,000 people have been infected by the virus that has killed over 1,800 people, the vast majority of them in China.

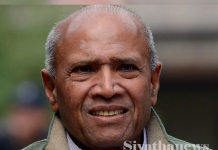

However, the company said it expected any impact to be temporary and BHP chief executive Mike Henry struck an upbeat note about the company’s long-term outlook.

“Despite near term uncertainty – due to the coronavirus outbreak, trade policy and geopolitics – we remain convinced about the positive underlying fundamentals of our commodities,” he said.

BHP issued the warning as it posted a US$4.8 billion profit for the six months to December 31, up from US$3.7 billion in the same period of 2018, largely on the back of higher iron ore prices.

Underlying profit – its preferred measure, which strips out one-off costs and is more closely watched by the market – rose 39 percent to US$5.2 billion, due to strong commodity prices and increased production.

The company declared a final dividend of 65 US cents, which it said was its second-highest return to investors.

Meanwhile, Anglo-Australian miner Rio Tinto said it was resuming operations in Australia’s Pilbara region after a destructive cyclone hit the area last week.

Tropical Cyclone Damien damaged roads, power lines and cut communications across the mining hub, causing Rio Tinto to downgrade its iron ore export expectations for 2020 by up to 20 million tonnes.

The company said it was working with customers to minimise disruptions to supply.